Key Concepts in Bookkeeping Shannonbabyy1516

Bookkeeping serves as the backbone of financial management, requiring systematic methods to record and organize transactions. Understanding ledgers is crucial, as they provide a structured approach to tracking financial data. The principles of double-entry accounting introduce a necessary complexity, ensuring accuracy through reciprocal entries. Additionally, the use of specialized tools and software can streamline these processes, enhancing overall efficiency. Exploring these elements reveals their significance in fostering informed financial decisions and long-term stability.

Understanding Ledgers and Their Importance

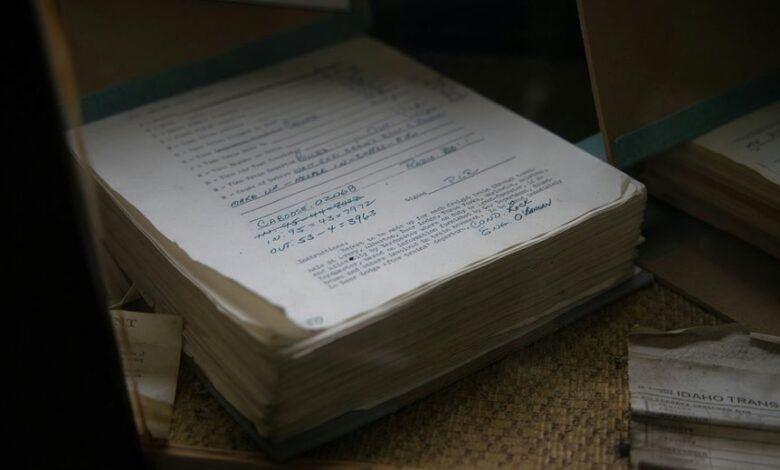

Ledgers serve as the backbone of financial record-keeping, providing a structured means of documenting all transactions within an organization.

Effective ledger organization is essential, as it facilitates comprehensive tracking and analysis of financial data.

Various ledger types, such as general, sales, and purchase ledgers, cater to distinct needs, ensuring that financial professionals can maintain accuracy and transparency in their reporting.

The Principles of Double-Entry Accounting

Although many financial systems may vary in complexity, the principles of double-entry accounting stand as a foundational element that ensures accuracy and accountability in financial reporting.

This method requires every transaction recording to affect at least two accounts, utilizing debits and credits. By maintaining this balance, organizations can provide a clearer financial picture, fostering trust and transparency in their financial practices.

Key Financial Statements Explained

Financial statements serve as the cornerstone of a company's financial health, providing critical insights into its performance and position.

These documents, including the balance sheet, income statement, and cash flow statement, enable stakeholders to analyze financial ratios and assess liquidity.

Understanding cash flow is essential for evaluating operational efficiency, ensuring the organization maintains the freedom to pursue growth opportunities without jeopardizing financial stability.

Essential Bookkeeping Tools and Software

Accurate financial statements rely heavily on effective bookkeeping practices, which are further enhanced by the use of appropriate tools and software.

Essential bookkeeping software provides automated solutions for tracking expenses, generating reports, and ensuring compliance, facilitating efficient financial management.

These tools empower businesses to maintain accurate records, promote transparency, and ultimately grant them the freedom to focus on strategic growth and decision-making.

Conclusion

In a world driven by technology and automation, the irony lies in the fact that the art of bookkeeping remains fundamentally human. As businesses embrace sophisticated software and tools, the essence of meticulous record-keeping and understanding the underlying principles becomes even more critical. Ultimately, while algorithms may streamline processes, it is the diligent attention to ledgers and double-entry accounting that truly safeguards financial integrity and informs strategic decisions, proving that some old-school methods are irreplaceable in modern finance.